|

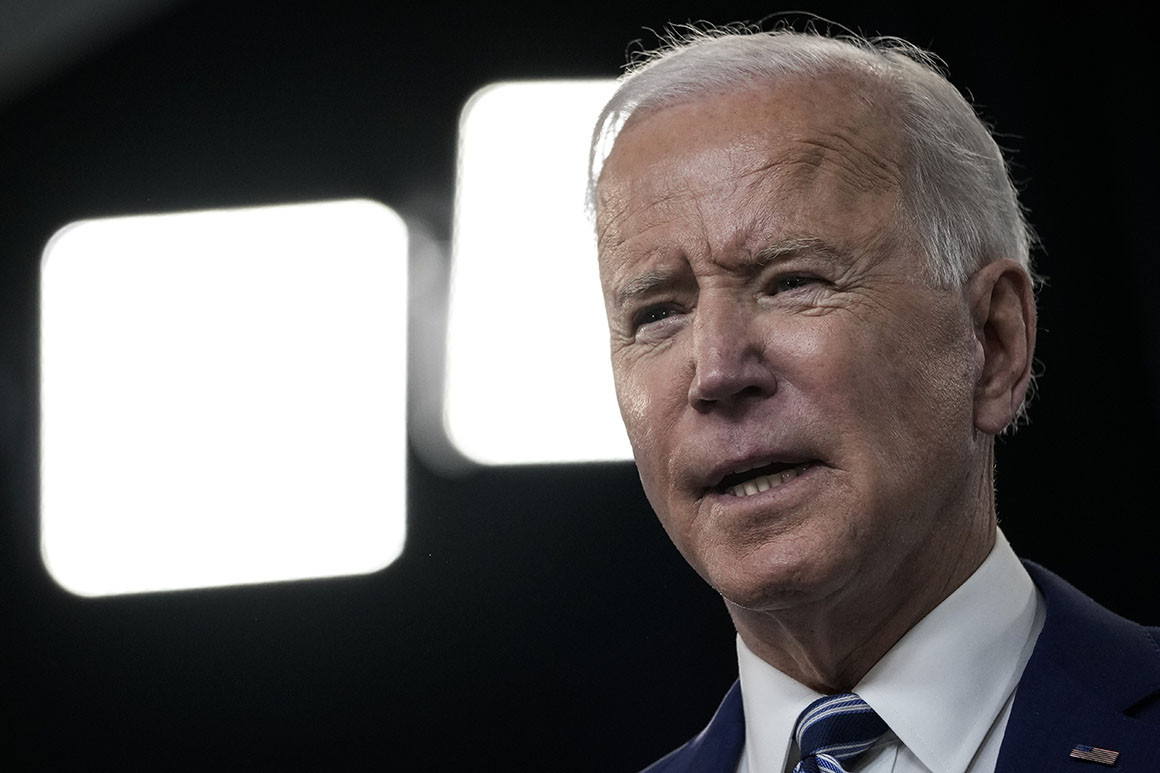

The Lead: BIden’s Change of Heart

credit: getty credit: getty

President Biden’s new tax plan may not hit corporate America as hard as previously thought. According to details from the Treasury Department, a 15% minimum tax would apply to companies with income over $2 billion. He campaigned on this tax applying to companies making over $100 million.

Why the change of heart? It is hard to say but perhaps the President wants some hope of GOP support, which his previous plan was unlikely to get. Or maybe he wants to stop U.S. companies from moving overseas to avoid taxes, which has also happened.

The deets

Under this new $2 billion threshold, only 45 U.S. companies would pay this tax.

The plan does raise the corporate income tax to 28%, up from 21%. It also proposes a global minimum tax for companies that do business internationally.

But remember, lawmakers write the tax code to incentivize what they want businesses to do. The President’s plan gives significant tax cuts to companies that move to clean energy production. It also offers credits for research, housing, and renewable energy. There is not yet much detail on those incentives.

|