|

Getting your Trinity Audio player ready...

|

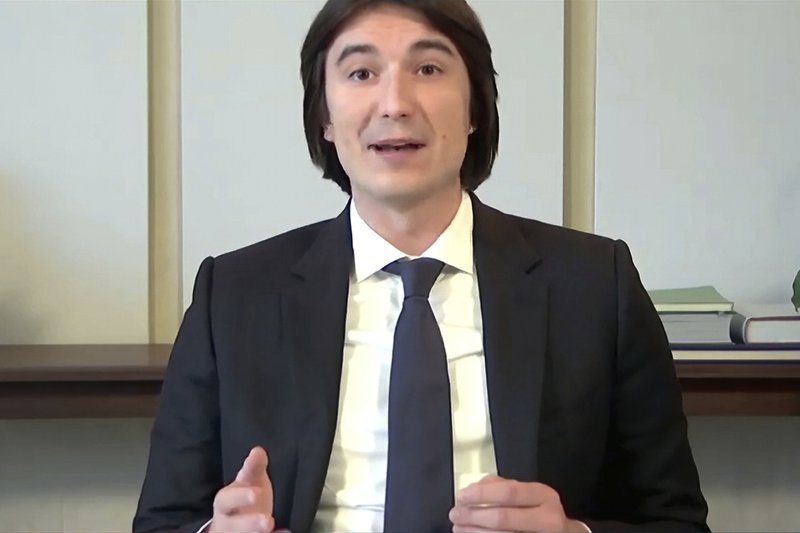

The House Financial Services Committee grilled a bunch of finance guys about the GameStop stock surge. They were particularly keen to grill Robinhood CEO Vladimir Tenev about its decision to stop users from buying the stock as it was surging.

Tenev maintains that his company had to do this because his clearinghouse had called his margins. This answer still has a few holes in it. For instance, if this was a joint decision between him and his clearinghouse because margins were too expensive, that means there was some wiggle room in the decision. So why wasn’t the clearinghouse called to testify? And why was his company allowing the sell-side of the stock if margins were being called? Tenev maintained the company line even as the questioning got hotter.

But, representatives also used the occasion to press Tenev and hedge fund managers on the legality of its business. Robinhood does not charge users to make trades but rather sells information about these trades to other firms so that they can make similar trades in advance and profit. This is legal and congress knows that. If they suddenly don’t like it, they can change it but grilling the players of the game because they are suddenly scandalized by it was annoying political posturing.

For instance, Gabriel Plotkin, CEO Melvin Capital, the hedge fund that lost money because his firm had been shorting GameStop was asked if he would support legislation that makes shorting illegal.

“Whatever regulation is put forth in the marketplace, we will obviously operate within those rules,” he said. “It’s not for me to decide but if those are the rules, we’ll certainly abide by them.”

Hey Congress, it’s your job to decide the rules. Not to pretend you are just getting wind of them and suddenly don’t like them.